Amazon Biz Model Canvas

Ecommerce is a trillion dollar vertical with different strategies reaching from owned inventory to platform business models. Approaches include online marketplaces, fully vertically integrated ecommerce, classifieds platforms, shopfront hosting, supply side aggregators, deals platforms, review pages, B2B marketplaces, payment providers and more.

Today, we are covering Amazon's eCommerce Business Model Canvas.

Amazon leverages two types of business models for their ecommerce businesses:

The linear business model for those parts that are directly sourced ("online stores" and "physical stores" in their terminology) and

The platform business model for Amazon Marketplace ("Retail third-party seller Services")

Overview

This article is structured in line with the elements of the business model canvas:

You will also get:

Revenue

Amazon Revenue 2009-2022 (source: tradingeconomics)

Let's start with the revenues to see which segments contribute most to their business results.

Amazon has long surpassed the competition in terms of online sales revenue. As of mid 2022, they are still trailing Walmart in terms of total revenue but the gap is closing.

Amazon revenue 2021: $469.8b

Walmart revenue 2021: $572.8b

How Amazon makes money - revenue by segment in 2022:

Based on their annual report 2022, Amazon makes 43% of their revenue through their linear/direct eCommerce business model, 23% through their Marketplace (being a platform biz model), 15% through Amazon Web Services, 7% through advertising service, 7% through subscription services (Prime being the biggest one). Amazon Online Stores fall under a linear business model which is incorrectly stated by many as a platform biz model. Only Amazon Marketplace is a platform business model within Amazon’s eCommerce endeavours.

Here’s the revenue breakdown in 2022:

Online stores: $220b (43%)

Physical stores: $19b (4%)

Retail third-party seller Services: $118b (23%)

Subscription services: $35b (7%)

Advertising Services $38b (7%)

AWS: $80b (15%)

Other: $4b (1%)

Source: Amazon Annual report (2021, pdf)

In this article we will focus on their main revenue drivers being the segments related to eCommerce / retail. We will see it spans a number of the above-shown areas.

Learn more about revenue generation in digital business models here.

Key Partners

We have elaborated in great detail on the key partners in some of our other articles (esp Uber, Netflix, Airbnb), hence we will keep it very brief here so that we can focus more on some of the other aspects. Check-out those articles as many of the broader comments are very relevant for Amazon as well.

A behemoth like Amazon of course has dozens of types of key partners (and of course thousands of actual "partners").

Let's look at some key types within their ecommerce segment:

Suppliers: For starters we have the many suppliers. As we will see shortly, these could be distinguished further into various types. There are those that are mere suppliers that Amazon buys from. There are the larger ones that Amazon has more elaborate contracts with (think of major brands like Dell, Nike, etc who may have a presence on Amazon). There are many authors and many more types of suppliers.

Then there are the "junior" partners of Amazon-owned brands.

Others are just manufacturers of Amazon goods (more on this shortly).

Transport partners: Amazon is insourcing an increasing amount of transport as it becomes more economical with scale but there are still a whole range of transport and logistics partners who are quite crucial in the value proposition of fast delivery.

Marketplace sellers: A separate type of "suppliers" are all the 3rd party sellers on Amazon Marketplace.

Tech partners: Similar to the transport infrastructure, Amazon is also insourcing a lot of their technology (and then selling services based to it, such as Amazon Web Services)

Learn more about key partners in digital business models here.

Amazon Business Model

Truly understand Amazon’s eCommerce business models.

5 eBooks covering:

Amazon Business Model: Fulfilment and delivery network

Amazon Business Model: Three Key CVPs

Amazon Kindle Biz Models

Amazon Subscription Models

Amazon eCommerce Biz Model Canvas

Key Assets & Resources

Amazon's key assets & resources (by a long shot) are:

Their Delivery and fulfilment network

Brand

Retail (Sales) IT assets including website, app(s) and the entire backend to it (incl the logistics IT backend)

Value delivery IT assets (incl for, Amazon Prime video, Kindle / KDP, Audible, AWS, etc) including all the backend to it

Delivery and fulfilment network

At the heart of Amazon's retail business model success is its delivery and fulfilment network.

Amazon Fulfilment & Delivery Network

A simplified view of how a product travels from manufacturer to the consumer through various layers of the fulfilment network. Depending on the product and the customer's location, there are different delivery pathways through the system.

As of August 2022, Amazon has over 1,200 facilities in the US alone and 2,200 globally. This is obviously a massive footprint. The facilities fall into a number of categories:

Inbound cross doc centre

Airport hub

Fulfilment centres (with various subtypes / those storing certain types of goods)

Sortation centres

Delivery stations

Prime now hubs

Amazon Fresh (which also has a pick-up option)

or brick-and-mortar retail, e..g. Amazon Book, Go, Whole Foods Market and Amazon 4 star

Each of these fulfilment facilities has its distinct characteristics and functions. If you want to understand Amazon, you need to understand this infrastructure. Amazon is an amazing example for a digital company with a huge tangible asset base.

Learn more about key assets & resources in digital business models here.

Value Propositions

Value Propositions for Consumers

“I very frequently get the question: What’s going to change in the next 10 years? And that is a very interesting question; it’s a very common one. I almost never get the question: What’s not going to change in the next 10 years? And I submit to you that that second question is actually the more important of the two — because you can build a business strategy around the things that are stable in time.

… [I]n our retail business, we know that customers want low prices, and I know that’s going to be true 10 years from now. They want fast delivery; they want vast selection. It’s impossible to imagine a future 10 years from now where a customer comes up and says, ‘Jeff I love Amazon, I just wish the prices were a little higher;’ ‘I love Amazon, I just wish you’d deliver a little more slowly.’ Impossible. And so the effort we put into those things, spinning those things up, we know the energy we put into it today will still be paying off dividends for our customers 10 years from now. When you have something that you know is true, even over the long term, you can afford to put a lot of energy into it.”

Jeff Bezos, Founder Amazon Inc.

In summary, Jeff Bezos called out Amazon's 3 key value propositions as:

Low Prices

Fast Delivery

Large Choice of products (and services)

While there are other value propositions, we will be focusing on these three within this article.

(1) Low Prices

We will look at the dynamic pricing strategies in the Key Activities section in a moment.

(2) Fast Delivery

Amazon offers "free" shipping on millions of eligible items for an annual (or monthly) subscription fee for Amazon Prime. $8b of these revenues are being attributed to fulfilment and delivery services. "Free" shipping was at the core of Amazon Prime and is still being valued highly within the overall Prime package as we will see a bit later. This value proposition becomes more valuable as Amazon adds more and more choice (see next value proposition) in that consumers can make more use of their free shipping option for more of their purchases (and therefore also shift more of their purchase needs to Amazon).

Being able to deliver ordered items fast and to do so in an economical fashion (i.e. shipping cost to remain low for the customer and Amazon) is a huge challenge. For starters it requires scale which in the earlier days meant that Amazon had to use 3rd party providers (and in part still does). Most importantly, there are trade-offs to be made between how much inventory to be held, replicated and located where, facility costs and other costs. In the course, we are elaborating in great detail on the delivery and logistics infrastructure which is crucial for the delivery pace.

(3) Large Choice of products (and services)

Amazon started with books and then quickly expanded into media through (physical) discs and DVDs. By now most of this is available in different digital formats.

Books are available via Kindle either by purchasing books or via Kindle Unlimited

Books can also be consumed via Audible in the form of audio books

Music via Amazon Music (which also includes Podcasts)

Videos via Amazon Prime Video

Then there is Amazon Prime which includes a slice of each of the above

In addition, consumers can buy anything under the sun from Amazon, from consumer electronics to car tyres as we all know.

More interesting are their growth areas. These add to the growing choice for consumers and growing revenues for Amazon. Let's look at some of their growth bets in terms of product categories.

Growth areas (product categories)

Amazon is growing in many directions at the same time and with that their value proposition in terms of choice (and of course their potential revenue sources).

Everything is moving to online retail but at a different pace. The items that are lagging may be the biggest opportunities of the future [source: statista]

While only a fraction of food/groceries are sold online, it is one of the largest forecasted growth areas for online sales. It's clear that Amazon will want to participate (or be the main player - and will face Walmart as a major competitor) in this lucrative category (esp. fresh food).

Learn more about the value propositions of digital business models here.

Online grocery sale revenue grew ahead of expectations during the pandemic. Source: S&P Global Market Intelligence

Amazon Business Model on a Page (B-MAP)

We have developed the Business Model on a Page (B-MAP) format to explain value creation in the most concise way.

Focusing on the crucial aspects of the business model, you can gain depth in just 30 minutes.

Included:

Large infographic with value creation and other biz model aspects

15 min walkthrough video

What’s more, we have decided to make our B-MAPs super affordable. Our contribution to get your innovation journey kick-started!

Here are some of Amazon's endeavours in the categories that are trailing have yet to meaningfully shift to online retail.

Food/groceries:

Amazon Prime Pantry: Groceries (dry goods) and household goods

Amazon Fresh: Includes also perishables and produce and stored & delivered in a cooled infrastructure chain

Amazon Prime Now: The essentials (range of 15,000 products and restaurant orders, etc) that can be delivered within 2 hours for free (or 1 hour with surcharge)

Whole Foods Markets (WFM): Amazon acquired WFM with their over 350 physical stores. WFM produce is starting to be delivered through Amazon's network

Amazon Go: Automated check-out and a range of popular products

Furniture:

Extensive range of Amazon and 3rd party furniture and appliances choices

Dedicated fulfilment facilities specialising on large items, such as furniture, sports equipment and more (Redsland, CA)

In the US, Amazon is already the largest online retailer of furniture and appliances with almost double the revenue of runner-up Homedepot

Online furniture sales has a projected compound annual growth rate of 11.9% (CAGR) between 2018-2022

Apparel:

"Amazon currently claims about 6.6% of the apparel market. That share is expected to increase to 8.2% by next year and further expand to 16.2% within five years" by the estimates of one analyst

Amazon fashion brands: Amazon launched seven fashion brands with some observers wondering if Amazon wants to get into the high margin apparel business at large scale

Zappos.com: the famous online shoe and apparel retailer has been acquired by Amazon in their first foray into apparel but still running under their own brand (while having moved operations of 2 of their warehouses to Amazon)

Prime Wardrobe: accessible to Prime members only. It allows apparel choices to be sent home for trying them on. Unwanted items can be returned for free (within one week)

Several fulfilment centres dedicated to apparel, like the massive one in Jeffersonville, IN

Amazon has patented clothing manufacturing-as-a-service

And they have opened a clothing manufacturing plant in Norristown, PA

Pharmacy/medication:

Amazon has already a large set of products in health and personal care

They also have a large assortment of medical, prescription-free products, supplements as well as over-the-counter medication

Amazon has acquired PillPack in 2017, an online pharmacy that provides consumers with prescription medication in prepackaged doses

Prescription medication has its own set of regulatory requirements (that includes transport requirements), with PillPack being licensed to ship prescription medication to most US states

They are also looking into expanding into entering the medical device market

Compared to other categories, Amazon is only in the early stages within the medical / health care sector and there are a range of scenarios for their long-term plans

Amazon, JPMorgan Chase and Berkshire Hathaway have created a non-profit health-care venture for their combined 1.1m employees that aims to introduce technology solutions to simplify the health-care system

The playbook

These are a few examples of retail categories that Amazon is expanding into. Each category would deserve their own article. But it gives some insights into how Amazon enters/grows new product categories:

Large choice of product offerings on their pages composed of Amazon-owned and 3rd party inventory

Acquisitions of suitable companies, mostly smaller ones (Whole Foods Market is the notable exception)

Starting a number of "secret" (Amazon-owned) brands within the category

Establishing a fulfilment and delivery structure with respective warehouses and other infrastructure (e.g. temperature-controlled delivery chain, bulk item handling, prescription drug management)

For some of the categories: integrating a subset of the overall choice as part of the Prime membership or dedicated subscription models, etc

Value Propositions for Sellers

Amazon has also value propositions for 3rd party sellers which is the second largest business segment by revenue as we have seen with over $100b in 2021.

Amazon Marketplace

More than 50% of items (in terms of units, not revenues) sold through the Amazon pages are from 3rd party sellers. One prominent seller is Nike after resisting for a long time. But most 3rd party sellers are much smaller. Amazon has opened their pages to 3rd party sellers in 2002 and the share of those sales has increased continuously.

Amazon Marketplace falls under the platform business model that we have covered in great detail on our pages. The revenue model is often a transaction fee as a percentage of the sales. This is often combined with other revenue sources, e.g. advertising as well as FBA, SWA, etc.

Fulfilment by Amazon (FBA)

Fulfilment by Amazon is a service that offers merchants to store their items in Amazon fulfilment centres and delivery infrastructure to reach the customer. It includes checkout and payment options, management of returns and more. Items can be used to sell through the Amazon pages or through other sales channels.

Shipping with Amazon (SWA)

Amazon has increasingly insourced elements of the delivery network and then opened it up to external customers as a service. They have started with the last-mile delivery using Amazon Flex drivers but have increasingly expanded on this. This used to be branded Shipping with Amazon (SWA) but is now included as an option in Fulfilment by Amazon (FBA).

Key Activities

One of the most important key activities is to constantly improve the value propositions.

The actual value propositions and even the pages have not changed a lot (even if you go back all the way to the early days). But within those early value propositions, continuous improvements have been made.

Let's take a look at one survey that asked what makes consumers buy on Amazon.

The main reasons that people buy on Amazon according to one survey [source: statista]

The value propositions combine the on-page and off-page elements that we have talked about.

Fast & convenient delivery: Their delivery infrastructure for example underpins some of the other reasons people purchase on Amazon, such as fast shipping and selection (selection requires respective special fulfilment and delivery capabilities as mentioned above).

Product choice: We already talked in detail about how Amazon works to add more product choice.

So, now let's look at the third important value proposition in terms of value propositions: price.

Pricing strategies

Prices are influenced by a number of factors. This includes sourcing prices which then depends on a number of factors itself including (for a set product grade / quality) on purchase prices which often can only meaningfully be negotiated down by volume, i.e. scale.

Another crucial ingredient to sustainably lower prices is a lower cost structure. For an online retailer, that translates into a cheaper-than-competition fulfilment and delivery infrastructure.

In addition, Amazon has long been known to accept a lower profit margin. Some of this was due to reinvestment but some was certainly also passed onto the customer in order to increase volume.

Then there is the other pillar of pricing strategies.

Note the nice feedback loop here.

Analysing many sources, we have found the following pricing strategies that Amazon leverages. More details to each of those can be found in the premium resources.

Price dynamism

Price perception strategy

Demand/supply pricin

Competition monitoring

Seasonal prices

Dynamic pricing for Marketplace

Bundling/recommendations

Deals/promotions

Data network effects

Deceptive pricing(?)

Another different set of key activities includes the development of completely new value propositions and offerings. One of the most successful ones (as you can see in the revenue section) was AWS.

Learn more about key activities in digital business models here.

Channels

Most notably, Amazon is a new channel for B2C retail.

The accompanying value delivery channels are:

Their websites and its various elements, such as product descriptions, a simple checkout, reviews, filter, search and navigation features, etc

Their various apps, incl things like the Kindle (reader) app, etc

Their transport and delivery channels

Amazon ticks all boxes (and sets the benchmark for some of them) when it comes to online retail experience [source: statista]

In addition, there are

Their different help and support channels on their website (which are functional but probably not award-winning)

Various forms of acquisition channels, incl digital and offline advertising and marketing

and a lot more more

Learn more about the channels of digital business models here.

Customer Relationships

Customer relationships are defined by the benefits sought/provided which are self-serving, low prices, convenience. In addition, it is very important that customers can safely purchase (and return if needed) the ordered items given they can touch and feel the items they purchase upfront.

There are many features on their website (and T&Cs) that help with these properties. We have already called out many of them.

Let's add here two additional points: the review system which allows for some transparency (though these systems are rarely perfect). They also provide the impression of power to the consumer and a channel for retribution. How true this is, is another question but such systems are very important. Another important aspect is personalisation that has various elements. Tailored recommendations are one such element.

Review system

Apart from low prices, reviews are one of the most important factors driving customer decisions. Would you buy something low-rated just because it's cheap? Likely not. Reviews are also one of the most important factors for the ranking of products on search pages. With this, there is big money at stake for sellers. And that means there are people trying to rig the system with fake reviews.

The review system is one of the most important decision and ranking tools

It is of significant value for Amazon as well as for 3rd party sellers on Amazon

Amazon has a range of community and review guidelines

Amazon encourages reviews, e.g. via the early reviewers program

They allow other users to vote on the helpfulness of reviews and display more helpful ones higher up (but this system has been used for manipulation itself)

Amazon shows the list of top reviewers based on helpful votes and has even a hall of fame for them

They have filters and machine learning tools to weed out fake reviews

Estimates of the number of fake reviews range from 1% according to Amazon vs 30% stated by fake-review detection sites (both of which have an incentive to over or understate the problem)

Personalisation

Recommendations are a part of Amazon's personalisation efforts. And they are essential to more sales. A 2012 McKinsey report finds that "Already, 35 percent of what consumers purchase on Amazon and 75 percent of what they watch on Netflix come from product recommendations based on such algorithms." Multiply the roughly 400 million products on Amazon with the hundreds of millions of users and you can easily see that this is a complex system to pull off.

Recommendations can come in different forms:

"Recommended for you"

"Frequently bought together"

"Your recently viewed items and featured recommendations"

"Your browsing history"

"Related to items you viewed"

"Best selling"

Off-site recommendations via email

Learn more about the customer relationships of digital business models here.

Customer Segments

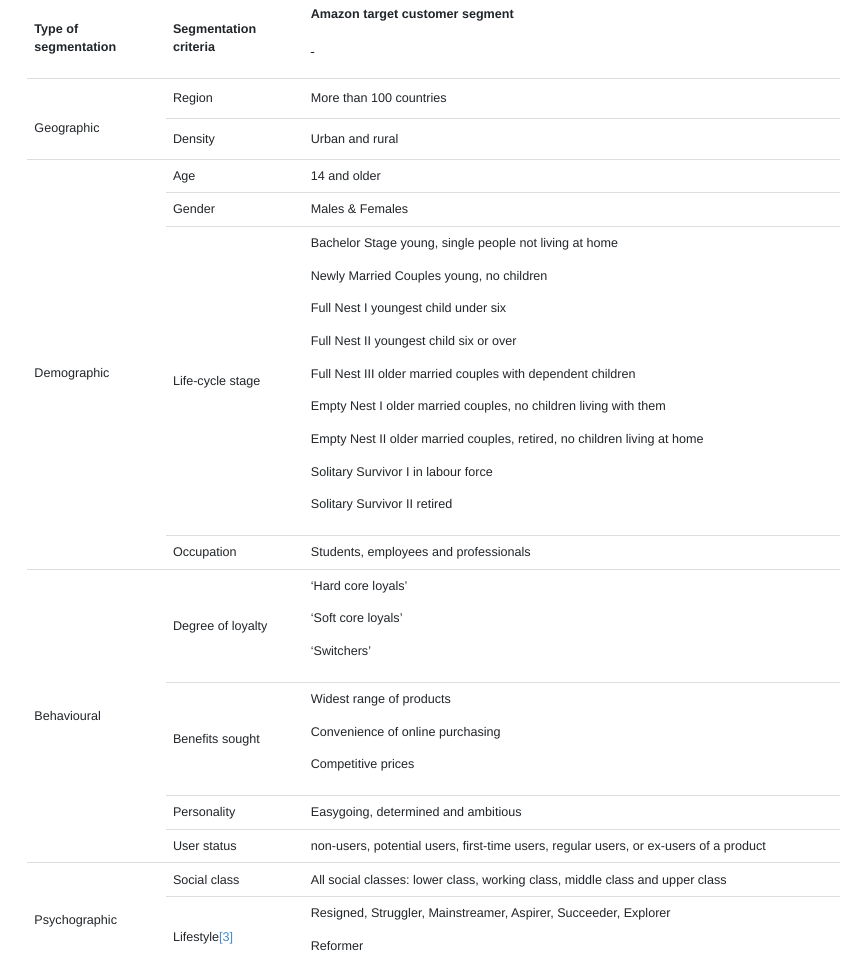

According to this source, Amazon segments their customers in the below-shown way. Following their sources, we couldn't confirm (nor refute) this claim.

It is however a fairly standard way of segmenting customers and one can see why it can make sense for Amazon.

In addition, Amazon would be using various ways of micro segmentation.

Learn more about the customer segments of digital business models here.

Cost Structure

Amazon's cost structure (source: annual report) is "as expected":

Cost of sales: 58%

Fulfilment: 16%

Technology & content: 12%

Marketing: 7%

G&A: 1.8%

The biggest cost item (by far) is the cost of sales with 58% of revenue (down by 1% from 2019). This cost item includes the cost of their inventory which undoubtedly would be the biggest cost item. Generating 47% of their revenue through the linear merchant model means that they have to pay for the inventory involved in this model.

Amazon cost structure (source: annual report)

Learn more about the cost structures of digital business models here.