Google Business Model 2023

Business Overview

“Our mission is to organise the world’s information and make it universally accessible and useful.” ~ Google

As of July 2023, Google holds a market share of over 90% in online search. Even the closest competitor Bing is degraded to only 3% market share. Most Google Search is composed of keyword search which allows for digital ads to be displayed that provide better returns on investment than traditional ad formats. Google’s main revenues come from selling advertisement inventory to businesses on an auction-basis. The inventory (made of digital screen space and targetable user characteristics) is dynamically generated every time a user enters search keywords and results are displayed.

A lot of the targetable characteristics are already in the search keywords themselves. A user “googling” mortgage-related terms is far more likely to be open to be displayed loan products than someone watching a soap opera on TV.

Google connects those seeking information with those providing the information that is being sought. Search results are composed of organic results and paid results placements. Paid placements are ads of various formats and are Google’s main revenue source. Connecting information seekers with providers of relevant information makes Google a platform business model.

How does Google make money?

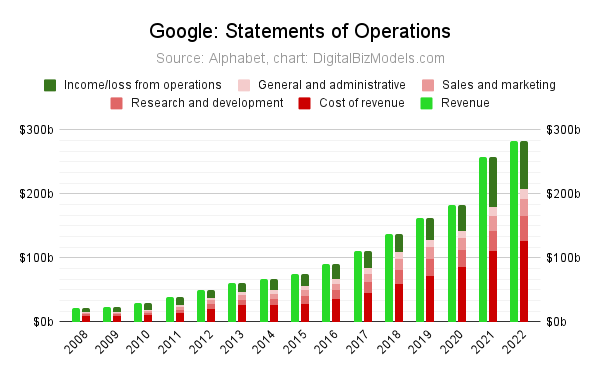

In FY22 Google (more accurately Alphabet, their parent company) made revenues of $283b which were composed of:

79% advertising revenues;

10% are made of YouTube subscriptions, hardware sales (e.g. Pixel), and Google Play (their app store);

9% on Google Cloud;

2% other bets and financial gains.

While the “other bets” category is small in terms of revenue, there are countless smaller and larger bets which at some stage may grow to something. Some of their biggest bets pertain to Waymo, quantum computing, AI, Wing (drone delivery) and even medical (Calico).

Who are Google’s main competitors?

On Search, Google’s biggest direct competitors are Bing and Yahoo. The biggest competitor in digital advertising is Meta (the parent company of Facebook, Instagram, WhatsApp) and Amazon. But of course, the list of competitors is very large. Take Apple Maps which is competing in the maps ad space and who recently announced to enter search. In addition, many platforms have announced plans for ad products, such as Uber Advertising (here the video link), Airbnb foreshadowing an ad product and Netflix’ ad layer. These are just a few emerging examples of many.

Then there are many other competitors for their other endeavours, such as Netflix being the competitor for YouTube and AWS as a competitor for Google Cloud.

In addition there are strategic layers of competition. The most important example is Apple’s iOS which is competing with Google’s Android OS / Chrome OS and making tracking of users more difficult with an increasing focus on privacy eroding at least some of Google’s targeting capabilities. Hence, as iPhone market share increases, some of Google’s search revenue could be affected (not to mention boosting Apple’s own search ad base).

Overview

This article is structured in line with the elements of the business model canvas:

Sources

Our key sources for the business model canvas and this article are:

Investor updates, including annual reports, quarterly reports

3rd party data, e.g. Similarweb, TechCrunch, Entrepreneur and other insights portals

We are highlighting direct quotes from these sources in “blue italics”

Value Propositions

Google is a multi-sided platform. It makes sense to distinguish among (at least) the following three types of participants:

Search Users

Website Owners such as brands, businesses, media/news, influencers, VIPs, etc

Advertisers are the subset of website owners that pay for ads. Note that many website owners do not run ads. From a Google revenue perspective that’s obviously a big distinction that we need to take into account

As a platform business model, Google needs to provide value to these participant types.

(1) Value propositions for search users:

Find/access information & solutions to problems: Users are trying to access information that they could otherwise not access. Often this is triggered by a problem that users are trying to solve (e.g. deciding on something, filling a knowledge gap, etc)

Lower search costs/efforts: Even where users could find the info they are looking for, search platforms provide access to it more conveniently and faster than traditional methods

And more, e.g. accessing information in most life situations, on the phone within a moment, etc. Things like preview snippets, etc have accelerated this further.

(2) VP for website owners:

Access to audience: access to incremental audience

Well-matched traffic: platforms will aim to match businesses with the best suited traffic and that’s what most website’s are after

Insights Free analytics tool Google Analytics and opportunity to increase rankings

Income: many website owners decide to participate as display network partners (via AdSense) and generate income based on impressions and clicks

(3) VP for advertisers:

Supply of new targetable advertising spaces: Google creates ad spaces on the screens of users who they can target better than traditional methods

Better advertising ROI an/or avoiding losing customers: often digital advertising should yield better returns on advertising investment. But even where this may not be the case, businesses may be forced to participate where their competition does so, in order to avoid losing customers

Low barriers to entry and exit + scalability: advertisers can advertise at lowest cost with no overhead cost of creating campaigns, etc which allows low small and medium sized companies, even individuals (sole traders, micro-entrepreneurs) to participate and scale as they grow

Learn more about the value propositions of digital business models here.

Revenue

In the Financial Year ending 31/Dec/22 Google’s total revenues were $283b. These were composed of:

Google Services:

Google advertising:

Google Search & other $162b

YouTube ads $29b

Google Network $33b

Google advertising (total) $224b

Google other* $29b

Google Services (total) $254b (ads plus other)

Google Cloud $26b

Other bets $1b

Hedging $2b

Total revenues $283b

* Includes YouTube non-advertising revenues (i.e. subscriptions), hardware sales (e.g. Pixel), and Google Play (their app store).

With this Google is diversifying away from advertising revenue only. And while it may not be quite where they would love to have it yet (given 79% is still ad revenue), it is also much further from where Meta is with their 98% reliance on ad revenues.

Learn more about revenue generation in digital business models here.

Key Partners

Google’s business model is one of the difficult cases where one can come to different conclusions about who is the supply side and who the customer.

From a revenue perspective, the users are the supply side as they supply the ad spaces with defined targetability characteristics. One could decide to add users to the key partners side. But, unlike in the case of Social Media, ordinary users have a more passive role as they dont create content, hence we’re not seeing a big case to add them to the supply side.

The truth is that the business model canvas is quite a limited tool and certainly not well-suited to describe search platforms (we do have similar problems with social media platforms).

With that we have

Website owners: Based on the above website owners are the (deliberately or not) key partners as they are creating the content that is being sought after. This can include many different types, such as: Brands, Businesses, Influencers, VIPs, Media/News, Blogs, Creators and many more

Ad display partners: Owners of digital properties who choose to display ads, e.g. websites using AdSense or apps (using AdMob)

Ad distribution partners: e.g. browser providers, mobile carriers, original equipment manufacturers, and software developers

Learn more about key partners in digital business models here.

Google Business Model Case Study

Find out how Google’s Business Model works in 2024!

Learn about all aspects of their business model including Value Creation & Monetisation and the details that you will not find elsewhere.

A special focus on the many fascinating AI-endeavours.

~50 pages (pdf) presented in a highly engaging format that is easy to read & understand. Read on your favourite reading device and learn what makes Google so successful.

Key Activities

Key business model activities pertaining to the value propositions of Google Search are:

Data capture via Crawling: The search process starts well before any users types a search query and it never stops. Google’s algorithms constantly crawl the internet by following links

Data organisation via indexing: Each page is being indexed for the words it contains (like the index of a book but for all words), analysed for numerous signals and organised in a search index. Google uses >200 signals with a combination of on- and off-page factors

Discovery & match: The key activity that Google performs is to match what it considers to be the best result to any given search. This is a big feat due to the billions of pages (estimated ~8b, on around 1.6-1.9b web sites with 400m active ones) available online and trillions of searches per year and the permutations across both. It happens through a “whole bunch of algorithms” (Google). Have a look at the infographics below that explain the steps involved (on a high level)

Presentation: Google not longer has a flat list of results. It uses different forms of search result presentation. For starters, it ranks the results with what it considers to be the most relevant result at the top. They are now delivering different presentation elements depending with the interpreted search intent

Learn more about key activities in digital business models here.

Key Assets & Resources

Technology: Google has many layers of technology, starting from hardware/server infrastructure, many layers of (distributed) software as well as network infrastructure and more

Algorithms: It’s been their algorithms that made Google big. Their original PageRank algorithm has dramatically evolved over time and takes over 200 signals into account when ranking search results. In addition they have many algorithms that work together to provide the different value propositions. This continuously-evolving asset is part of their critical intellectual property

Content/information: in particular the websites they crawl and the internal representation thereof for the purposes of search results delivery. This also includes data & content published on the internet (collected via crawling and/or data scraping), such as shopping data; Then there is data from external sources & databases, e.g. flight, hotel data, etc

Data: Google collects a lot of data, such as usage data on the platform, usage data off-platform (tracking), user profile/personal data, user-generated content (e.g. mails, reviews, documents) and a lot more. This kind of data helps with making ads more efficient as well as providing personalisation

The Google brand is synonymous with search. The term “Googling” has become synonymous with searching for something on the internet and has found its way into dictionaries. In the renowned Interbrand brand ranking, they have been ranking in the top-5 for many years in a row

It is clear that we are focussing only on the basics of Google Search here. A wider review of their products would fill many books.

Learn more about key assets & resources in digital business models here.

Channels

As per our discussions above Google needs to treat the three key participant types (1) Search users; (2) Website owners; (3) Advertisers as customers to which channels have to be established.

A majority of Google’s channels pertain to the most diverse and by-far largest participant type: Search Users

(1) Channels for search users

Google’s key value delivery channels are:

Web browsers & their URL fields which in most browsers directly trigger a search unless a valid URL has been entered. This was not the case in the early days

Being the default search engine: For most people and browsers, Google is the default search engine. In combination with the above (the URL field), it triggers trillions of searches annually

Android OS, Chrome OS / browser, Maps, etc: Google gives users many free tools which trigger search activities (and data capture) or have Google Search set as default (e.g. Android/Chrome OS)

User acquisition channels are:

Word-of-mouth: “Googling” says it all

Free Chrome browser: Google copied the playbook of Netscape but with more long-lastinng success to give out the browser for free (which at the time was by far the fastest) and use Google as the default search engine

Free Android OS / Chrome OS: these are free to licence for mobile phone manufacturers who dont want to go through the complex task of developing an OS. The free licence comes with the obligation to pre-install some of Google’s tools (further some cannot be uninstalled)

(2) Channels for Website owners

The most important channel between Google and website owners is Google Analytics: a free tool that, however, requires website owners to install a tracking code on their website which will give Google deep insights into the users of their website. It will also give Google massive amounts of data for ranking websites as well as improving their ranking algorithms over time. This data and their market dominance in the install base of tracking code is a huge competitive advantage

Google has also AdSense for those websites and apps that are willing to display ads (mostly the good old banner ads that you know). This is a key part of Google’s display network and a major driver of the associated revenue that we have seen

(3) Channels for Advertisers

The main channel is Google Ads: a portal through which advertisers can set-up the simplest to the most complex ad campaigns. It can also be connected with Google Analytics for a closed-loop AI-optimised process to get the best return on ad investment

All display areas: such as search results, websites, apps and other digital properties

Learn more about the channels of digital business models here.

Customer Relationships

From the perspective of the business model canvas methodology, all relationships are self-serving.

But this is not sufficient to characterise customer relationships. We are looking at customer relationships from the perspective of underlying human needs underpinning the actual value propositions. And we have to do this for the key participant types of the multi-sided platform (1) search users, (2) website owners and (3) advertisers.

(1) For search users:

Empowerment: Google helps accessing valuable information that was inaccessible to many and does so at a pace simply unimaginable previously. With that “Googling” has become synonymous with obtaining information or knowledge (though of course the actual knowledge is on the destination websites that are not owned by Google). In addition, Google is free (including browser) despite empowering characteristics

Reliability: avoiding platform manipulation is very important as it will otherwise lead to bad search results and impact customer retention. Worse yet, if scam and fraud pages rank high, this would reflect even more poorly on Google. Avoiding platform manipulation was the primary focus of all major Google updates until the mid-2010s and instrumental to their success

Privacy has become an important topic and could deter users. Google provides large amounts of control over privacy settings for those that care about it

(2) For website owners:

Opportunity: Being able to reach an unprecedented number of website visitors directly has opened opportunities to many website owners. And while technically speaking this opportunity was provided by the internet itself, Google channelled internet traffic and helped those that successfully ranked high to grab this opportunity. The prospect of being able to benefit from this opportunity is the most defining characteristic between website owners and Google even though it did not materialise for many (as is the case for the supply side on most platforms and marketplaces)

(3) For advertisers:

Empowerment: even the smallest business can now start with digital advertising within half a day even if they have never done it before. But the advertising tools are suited from the smallest to the largest firms with a very extensive and automatable feature set, many different ad formats across many displays

Self-serving: Google Ads are self-serving for advertising of all sizes. Many businesses will still use agencies, esp for the overall campaign aspects but can also do everything in-house if they wish to do so

Learn more about the customer relationships of digital business models here.

Customer Segments

(1) Search users:

The most important aspect of segmenting users is for the purposes of providing the best targetability for their advertising customers. Beyond keywords, Google offers many other way of targeting user segments: Geographic, geo-demographic, interest are some of the most important dimensions by which Google provides targetable user segments to advertisers

Behaviour, Technology: For their internal purposes, Google will segment users by factors like device type, by used browser, screen sizes, user behaviour, etc. This type of segmentation is the optimisation of their value propositions, e.g. to not lose mobile phone users to other forms of accessing the internet

Geo-demographic segmentation also plays a role in their growth planning and marketing efforts

(2) Website owners:

By vertical: Which search vertical does it cover (there can be hundreds: financial, medical, legal, travel, product/industry, etc with thousands of subverticals)

Keyword clusters: Which keyword clusters (and actual keywords therein) do the respective pages aim to serve

Type of page: commercial / non-commercials, education, news, blog, brand, creative / artist, etc

Traffic size/sources: distinguishes between smaller and larger pages in terms of daily/monthly/annual website visitors. Add to this the mix of traffic sources

(3) Advertisers:

Some of the most important advertiser segmentation factors are geography, industry and company size

Other segmentation factors are by the types of ad formats, campaign types, advertising tools used and other technical usage factors

Segmentation factors shown under website owner: advertisers will do better in the ad space auctioning mechanism when there is better alignment between their ads and their website (called quality factor)

Learn more about the customer segments of digital business models here.

Cost Structure

The cost structure looks similar to other tech players. The biggest difference are Traffic Acquisition Cost (TAC) which are part of the direct cost and therefore captured in the cost of revenue.

Cost of Revenues (45% of revenue FY22):

Traffic Acquisition Cost (TAC) includes: “[1] Amounts paid to our distribution partners who make available our search access points and services. Our distribution partners include browser providers, mobile carriers, original equipment manufacturers, and software developers. [2] Amounts paid to Google Network partners primarily for ads displayed on their properties.”

Other content costs, such as licencing of video content, etc

Direct cost in relation to data centres and other operating costs as well as depreciation, among others

TAC was $49b = 17% of revenue and other costs of revenue were $77b = 28% of revenue in FY22

R&D costs (14% of revenue FY22)

Sales and marketing (9% of revenue FY22)

General & Admin (6% of revenue FY22)

Beyond that the biggest difference it that Google has been profitable for many years (which seems to be worth calling out these days in the tech space).

Learn more about the cost structures of digital business models here.

Crucial Concepts in Digital Technology

A deep dive into the concepts that make digital biz models succeed!

Social Networks and Search Engines, like Google, Facebook, Twitter and Pinterest are some of the best examples to understand the crucial business management concepts in digital technology.

Learn in this ultra-dense study not only about the business models in Search and Social but also about crucial concepts transferable to other digital platforms.

Instead of explaining these crucial concepts in theory, we are using Social Media & Search Platforms as real-world examples.

You will not find the ideas explained in this top-consultancy & elite university grade book elsewhere in the open market.

Click here to download a free 20-page excerpt (full study >125 pages).

This is a must-read book for anyone serious about Digital Technology business models!